Unlock Faster Funding: The Benefits of DSCR Loans

Debt Service Coverage Ratio (DSCR) loans have emerged as one of the hottest financing options for real estate investors. Offering flexibility, ease, and speed, DSCR loans enable borrowers to qualify for financing based on a property's cash flow instead of personal income. Investors should consider a DSCR loan if the property generates reliable rental income, the investor is looking to grow their real estate portfolio quickly, or borrower personal financials are complicated or not conducive to conventional lending requirements.

DSCR Benefits

DSCR loans are an excellent financing option and offer the following benefits:

Focus on Property Cash Flow. No personal income documentation as DSCR loans primarily assess the property’s ability to generate income to cover its debt obligations. The loan is approved based on the property's cash flow relative to its debt payments (DSCR), often simplifying the approval process compared to traditional loans.

Qualifying Flexibility. Investors can focus on properties with strong rental or business income potential, even if they have complex personal financial profiles.

Enables Portfolio Growth. There is no cap on the number of properties owned. This allows investors to scale their portfolios more aggressively. Since DSCR loans focus on individual property performance, securing financing for multiple investments becomes simpler.

Streamlined Process & Faster Approvals. With fewer personal financial documents required, the underwriting process is typically quicker. The emphasis on the property’s income reduces the need for detailed tax returns or personal income verification.

Tailored for Real Estate Investors. DSCR loans align with the goals of investors who prioritize properties with steady cash flow. These loans are ideal for creating or expanding a rental property portfolio focused on income-producing assets or utilizing equity in existing assets to buy more rental properties.

How it works

DSCR loans are evaluated based on the Debt Service Coverage Ratio (DSCR) which is income divided by debt. Lenders evaluate a borrower's ability to repay the loan by analyzing the income and expenses for the property. A typical qualifying DSCR ratio is at least 1.2, but Fidelity has some options available for as low as 1.0 DSCR.

Fidelity Bancorp Funding uses gross income, not net operating income, when calculating the DSCR which is a massive benefit for investors. This provides access to greater financing proceeds while making it easier to qualify and receive more meaningful rates. Using a recently closed loan as an example, Fidelity provided a $1.3 million loan at a 5.75% interest rate with 58% LTV based on a 1.2 DSCR using gross rents. At the same rate and DSCR, the same loan qualified for only $980,000 in loan proceeds based on net operating income using 30-year amortization and a 35% expense ratio. The use of gross over net income provided the borrower $320,000 more capital which is a 24% increase in loan proceeds.

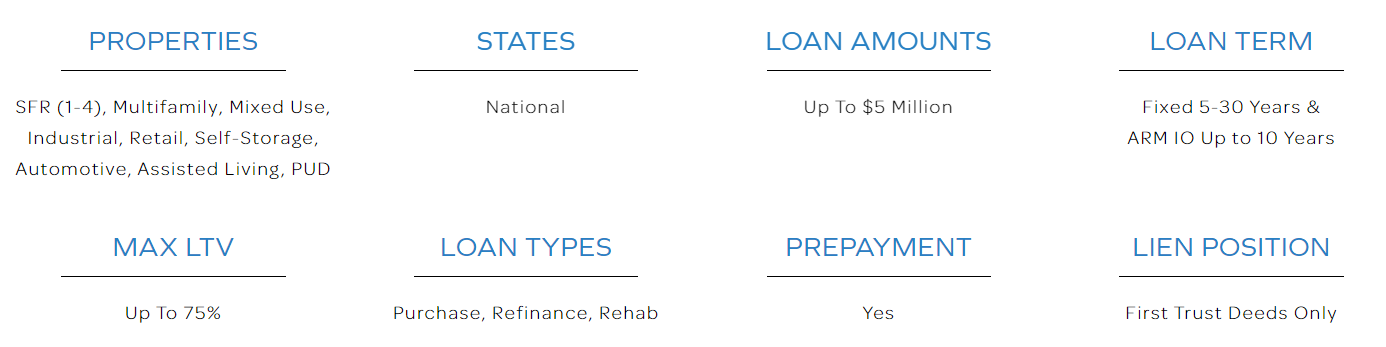

DSCR Loan Terms

Offering loan amounts up to $3 million, DSCR loans provides both fixed terms (ranging from 5-to-30 years with 25–30-year amortization) and adjustable-rate options with interest-only terms from 5-to-10 years. DSCR requirements begin at 1.00x, allowing borrowers to leverage a range of financing solutions that align with their investment goals. Interest rates are competitive with flexible prepayment options available.

About Fidelity Bancorp Funding

With over 25 years of experience, Fidelity Bancorp Funding is a leading bridge and permanent financing lender. Having funded over $15 billion in loans and earned the trust of 11,000 clients, we specialize in tailored real estate financing solutions that close quickly and with certainty. With access to $1 billion in bridge capital and strong bank relationships, we deliver customized bridge and commercial loan options to meet diverse needs. Contact us to learn how we can support your investments and borrowing needs.